Apple is Fighting for TSMC Capacity as Nvidia Takes Center Stage

[Exclusive] A 15-year relationship helped TSMC grow and Apple leap ahead of rivals. But now the iPhone maker is struggling to get access to chip production as it competes with Nvidia for wafer supply.

When CC Wei visited Cupertino last August, he had bad news for his largest client. Apple would need to acquiesce to the largest price rise in years, TSMC’s CEO told its executives.

Tim Cook and his team took the news on the chin. Wei had been telegraphing hikes in earnings calls over the past few quarters, and the Taiwanese chip maker’s rising gross margins were testament to its increasing pricing power.

That wasn’t the worst news, my sources tell me.

Apple, which once held a dominant position on TSMC’s customer list, now needs to fight for production capacity. With the continuing AI boom, and each GPU from clients like Nvidia and AMD taking up a larger footprint per wafer, the iPhone maker’s chip designs are no longer guaranteed a place among TSMC’s almost two dozen fabs.

What Wei probably didn’t tell Cook is that Apple may no longer be his largest client.

According to Culpium analysis and discussions with sources in the supply chain, Nvidia likely took top spot in at least one or two quarters of last year. “We don’t discuss that,” Chief Financial Officer Wendell Huang told Culpium Thursday when asked about the change in client rankings.

Final data will be unveiled in a few months when TSMC releases its annual report — which includes revenue from its top clients — but there’s every chance that Apple’s lead for the full year narrowed significantly and may have even fallen below Nvidia’s. If it didn’t happen in 2025, then it’s almost certain to do so in 2026, my sources tell me.1

Public data helps tells the story.

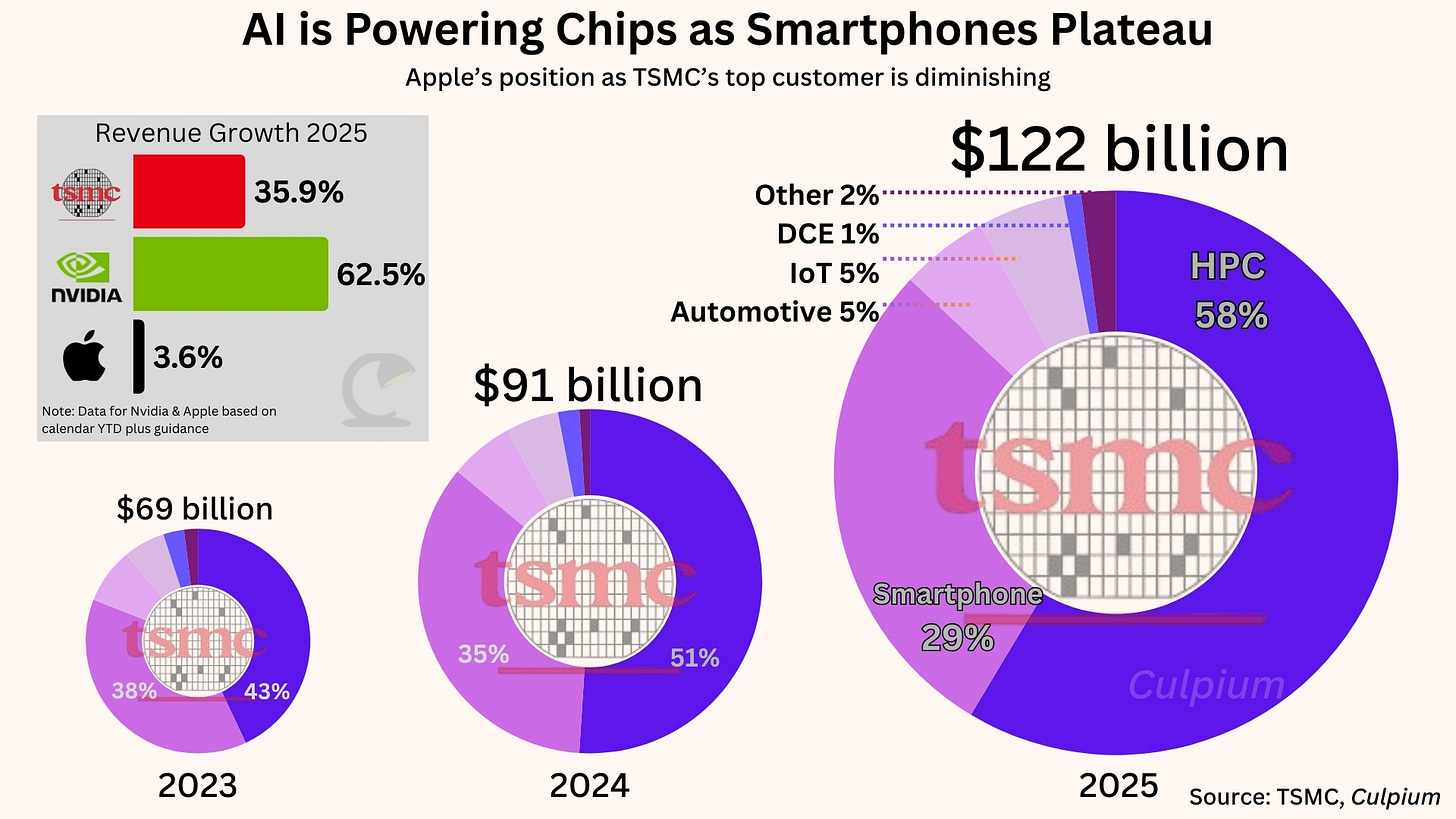

TSMC’s revenue climbed 36% last year to $122 billion, it reported Thursday. Nvidia’s sales for the fiscal year through January 2026 is set to climb 62% while Apple’s product revenue — which excludes services — is on track to grow just 3.6% for the 12-months to December 2025, according to Culpium estimates based on earnings reports and company guidance.

Apple’s role as the primary driver of TSMC revenue growth ended five years ago. In 2018 TSMC sales would have even fallen if not for incremental purchases by Apple that year. Now, the Cupertino company is posting low single-digit revenue growth while Nvidia is skyrocketing.

The reason for this change is two-fold, and pretty obvious: AI is driving massive demand for high-powered chips, while the smartphone boom has plateaued.

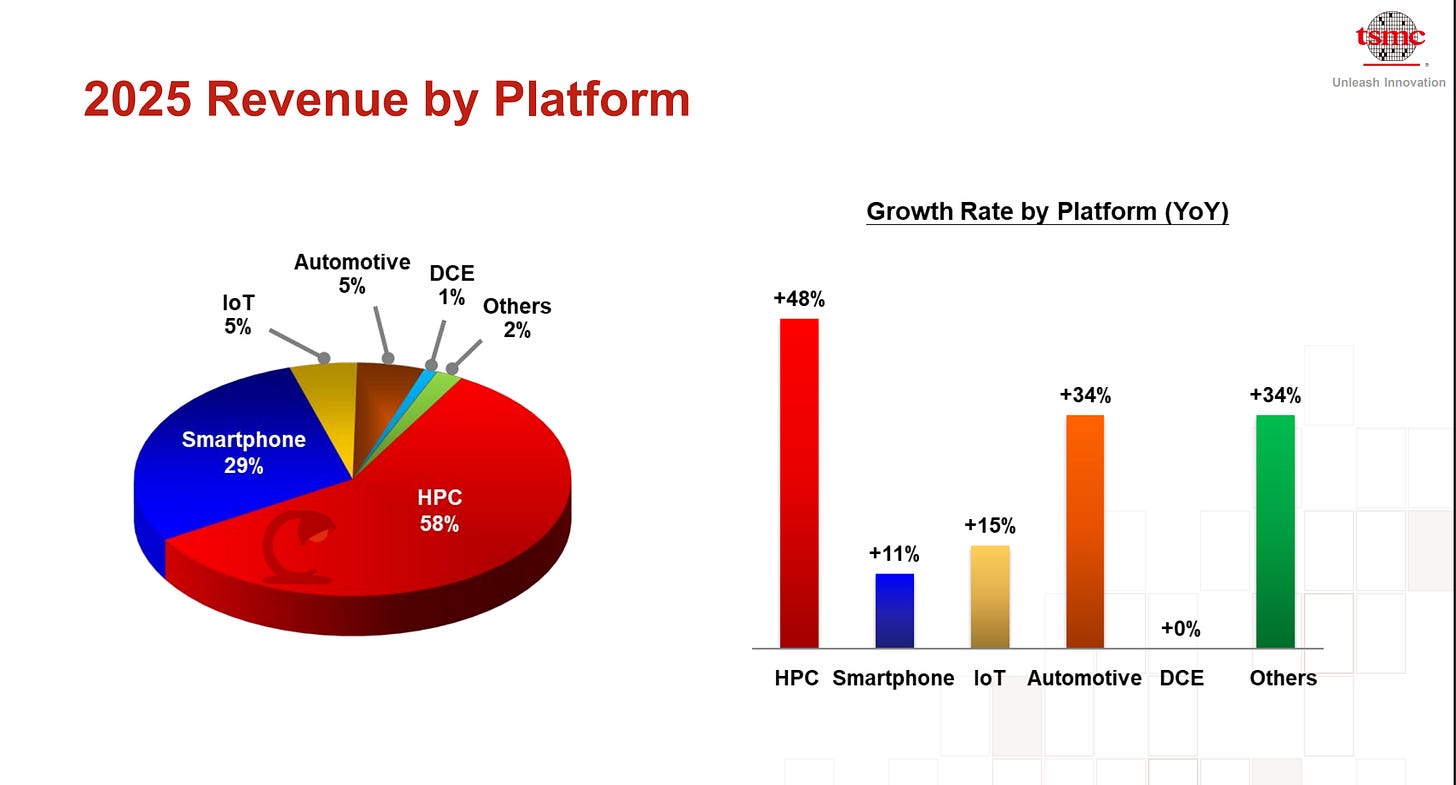

TSMC’s sales from high-performance computing, which includes AI chips, climbed 48% last year on top of 58% growth the year before. Smartphone revenue climbed just 11%, slower than 23% in the prior year.2 That trend will continue this year, and for the foreseeable future.

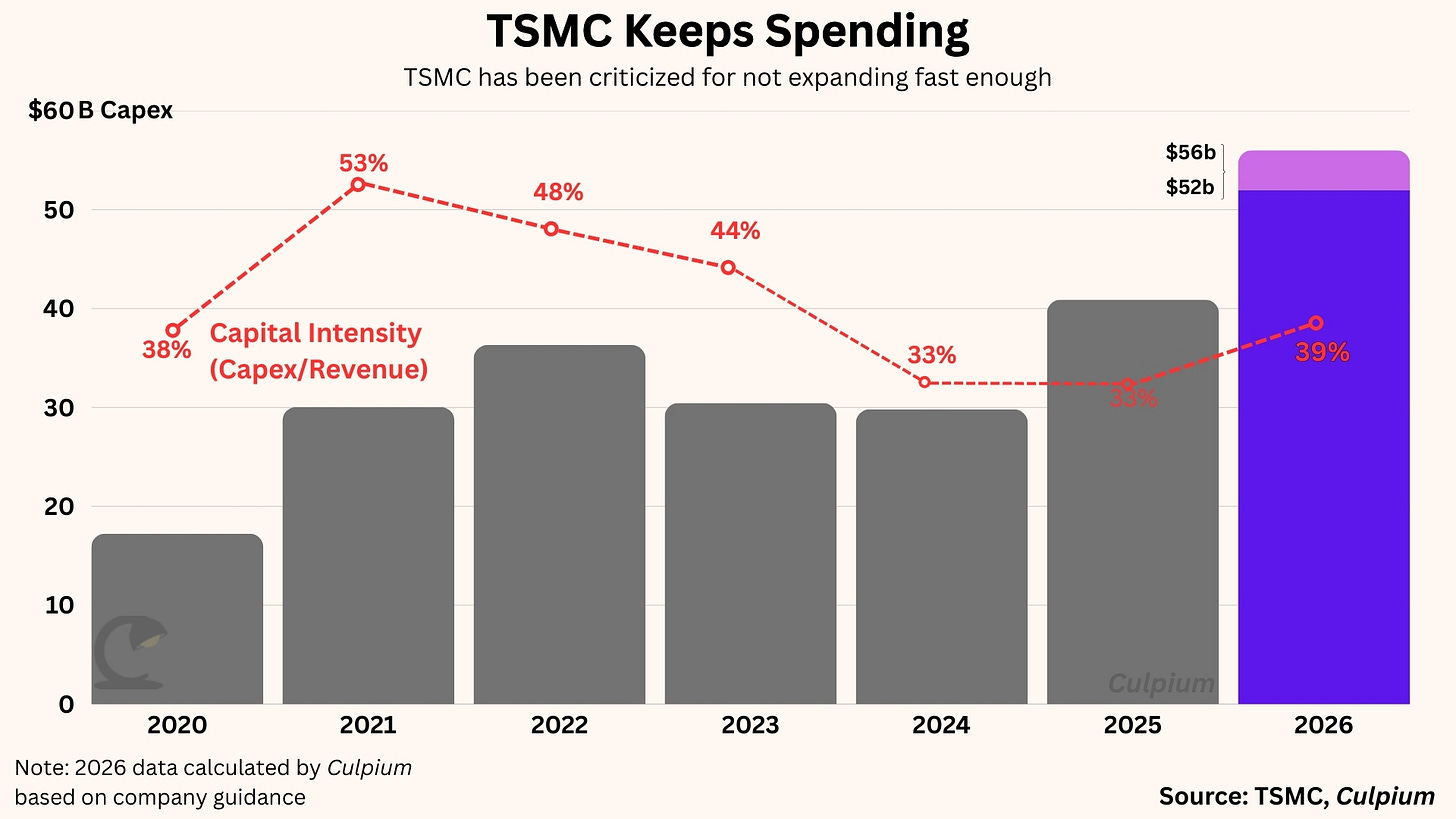

Revenue in 2026 will rise close to 30%, yet capital expenditure will climb around 32% to a record of somewhere between $52 billion and $56 billion, TSMC said Thursday. Longer term, growth will average 25% in the five years through 2029 yet the AI segment will climb an average of 55% or more over the same period, the company said. That’s higher than a prior forecast for a mid-40 percent figure.

The ultimate flex for TSMC came Thursday when it showed off not only record revenue and net income, but a gross margin approaching that of software makers and fabless chip designers. In the December quarter, that figure was an astounding 62.3%, 280 basis points higher than the prior period. If not for its overseas fabs (Arizona and Japan) gross margin would have been even higher.

There are two caveats that are important. First, while smartphone processors are the largest portion of chips bought by Apple, they’re not the only type. Processors for Macs come under HPC, while it also has a strong lineup of custom chips used in accessories which fall under digital consumer electronics. Second, Nvidia isn’t the only HPC client. AMD is a major buyer of capacity for its own GPUs while Amazon and Google are on the growing list of customers developing in-house AI chips.

Put another way, Apple’s chip catalog is broader and more varied, while Nvidia’s lineup is more concentrated around a huge number of wafers at, or near, leading-edge. It’s for these reasons that Apple will remain important for at least another decade.

In the near-term, however, TSMC’s technology roadmap coupled with broader industry trends favor Nvidia, AMD and their ilk, meaning Apple may need to keep fighting for capacity over the next year or two.

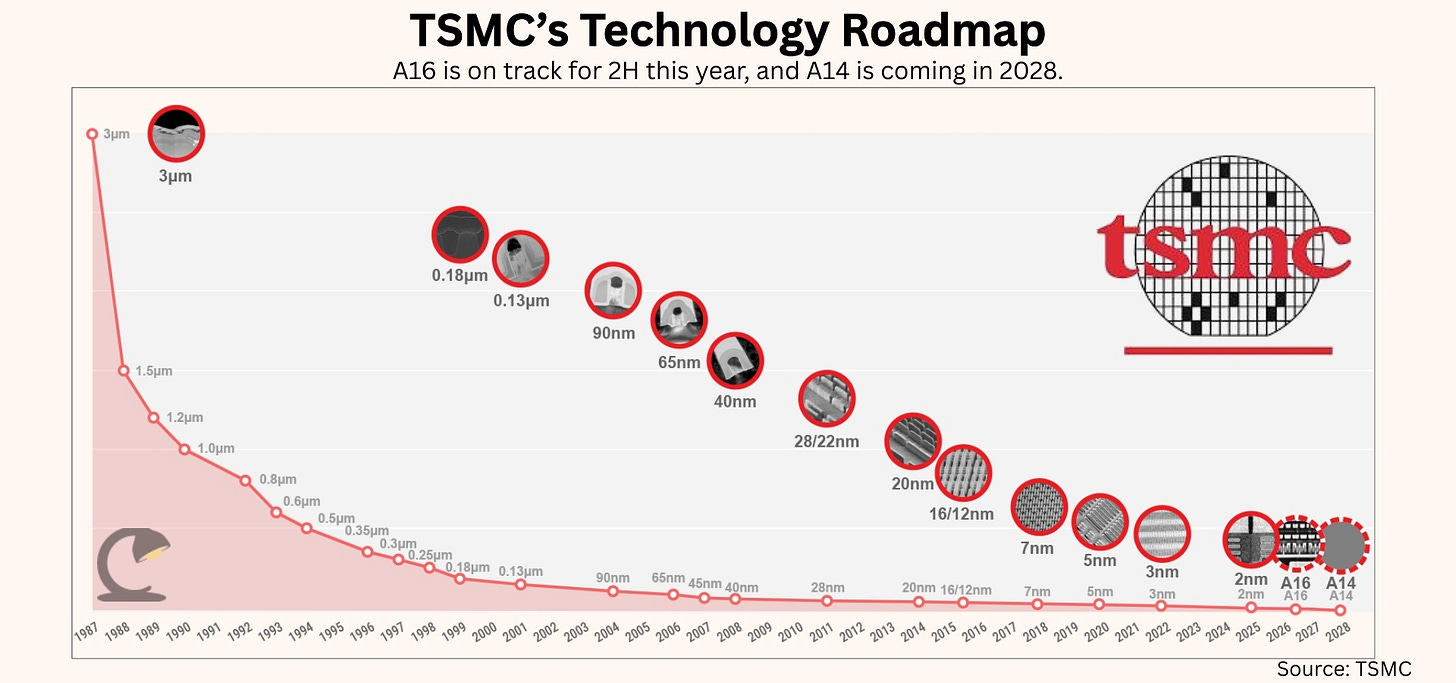

TSMC is already producing chips in volume at 2 nanometer (called N2), currently its most advanced node, with Apple a major buyer. But in the second half of this year it’s set to ramp up both a new variant called N2P as well as a new node called A16.

The company’s business model is a little quirky. Instead of repurposing an existing factory for new technology, TSMC just builds a new one. This ensures no interruption to output and allows it to squeeze the most out of old tools and processes. In general, this means any new capacity that TSMC builds is for a new node. As a result, it has numerous fabs still churning out chips on technology that’s a decade older or more.3

In TSMC CEO CC Wei’s words A16, with Super Power Rail, is “best for HPC with complex signal routes.” SPR is TSMC’s version of backside power, a newer approach designed to separate a chip’s signal from its power supply. Intel is also developing this technology, and many believe it’ll be the key to the US company’s prospects at stealing foundry share from its Taiwan rival.

After that, TSMC has A14 which it expects to bring into volume production around 2028. Some call this the next full node after N2, labeling A16 as not a “full node.” In truth, all of these names are as much marketing terms as they are technology designators. Nevertheless, as SemiAnalysis recently wrote in a fabulous report on the TSMC-Apple relationship, the balance will shift back to Apple because A14 is designed “for both mobile and HPC from the start.”

More importantly, what Apple offers is stability. Nvidia has been a client for a lot longer than Apple, but broadly speaking it’s a bit niche. Right now that “niche” is the hottest product on the planet, but niche it is. Apple, on the other hand, has products being made in no fewer than a dozen TSMC fabs. Even if Nvidia did overtake Apple by purchases, the breadth of its manufacturing footprint at TSMC is nowhere near as large.

This distinction may not matter now, but it probably will at some point. The AI boom won’t last forever. The bubble may burst, or it may slowly deflate, but the growth trajectory will surely flatten and that means demand for leading-edge AI chips will fall.

Wei knows this, which is why he’s expanding both quickly yet cautiously. “I am also very nervous,” he said at the company’s investor conference on Thursday in Taipei. “If we didn’t do it carefully, it would be a big disaster for TSMC for sure.”

The chip giant has recently come under fire, including from noted analyst Benedict Evans, for being “unwilling/unable to expand capacity fast enough to meet Nvidia’s book.” I think this is wrong, and unfair.

“The risk of under-investing is significantly greater than the risk of over-investing,” Evans cited Google CEO Sundar Pichai as saying back in 2Q 2024, as if to make the point. TSMC and Alphabet, Google’s parent, have approximately the same gross margin. But their business models couldn’t be more different. Nvidia’s financials are also unlike TSMC’s. Their respective capex strategies need to reflect this risk.

Alphabet’s capital intensity, calculated as acquisitions of property, plant & equipment divided by revenue, was just 15% for full-year 2024. TSMC’s is more than double that at over 33%. More importantly, depreciation — which is where the cost of capex is reflected in earnings — was just 10% of Alphabet’s cost of revenue. For TSMC, this figure is more than four times higher at 45%.

At Nvidia, which is a tier-one buyer of TSMC’s output, the data is more stark. Capital intensity was just 2.5% for 2024, while depreciation was only 5.7% of the cost of revenue. As a fabless chipmaker, it can enjoy gross margins of over 70%. Its only real risk is holding excess inventory. Even then, it could have written off its entire inventory at the end of October and still maintain a gross margin approaching that of its chief supplier. What’s more, neither of these clients have anywhere near the customer-concentration risk of TSMC.

The complaint that TSMC could and should build faster ignores the fact that it’s the one left holding the baby if a downturn comes and demand falls. It takes two to three years to build a new fab, Wei explained, so the company must skate where the puck is going without thinking too much about where it’s been. “Even if we spend 52 to 56 billion this year, the contribution this year is none,“ Wei said Thursday. Its major cost, buying equipment, remains on the books no matter what revenue it brings in for the quarter.

For the best part of a decade, Apple was the one driving TSMC’s need to keep spending on new facilities. Today it’s Nvidia, and Jensen Huang is starting to wield more power than Tim Cook. But neither has to bother with the expensive business of actually manufacturing semiconductors, merely the hassle of begging CC Wei for wafers.

For such clients, the foundry’s capacity is a fixed cost that they needn’t worry about. Which is precisely why eight of the world’s ten largest companies turn to TSMC to make their chips,4 and in return the Taiwanese giant gets to reap the rewards during boom times like this.

Thanks for reading.

More from Culpium:

None of these companies state their purchase and sales relationships explicitly, but instead use terms like Customer A and Vendor Y when providing numbers.

Prior to 2019, TSMC categorized revenue by Communications, Computer, Consumer, and Industrial but the data still reflects this smartphones v HPC dynamic.

This is not ALWAYS the case. In recent years it has repurposed old fabs, but that’s the exception and not the norm.

The other two are Saudi Aramco and TSMC itself.